October 2023 Economic Update

In the ever-evolving landscape of global economics, recent developments across the Americas, Europe, Asia, and Africa have captured the attention of investors, policymakers, and analysts alike. From surging inflation in the United States to political upheaval in Argentina and economic strategies in Italy, this month’s economic update delves into key events shaping the world's economic landscape. Additionally, we delve into Afghanistan's unexpected currency rebound, China and Russia's growing partnership, and the World Bank's mixed economic forecasts for Asia. Lastly, we explore China's significant investment in Morocco and Angola's response to fuel subsidy protests. Stay informed about the latest economic trends and their potential implications for your investments and financial decisions.

Americas

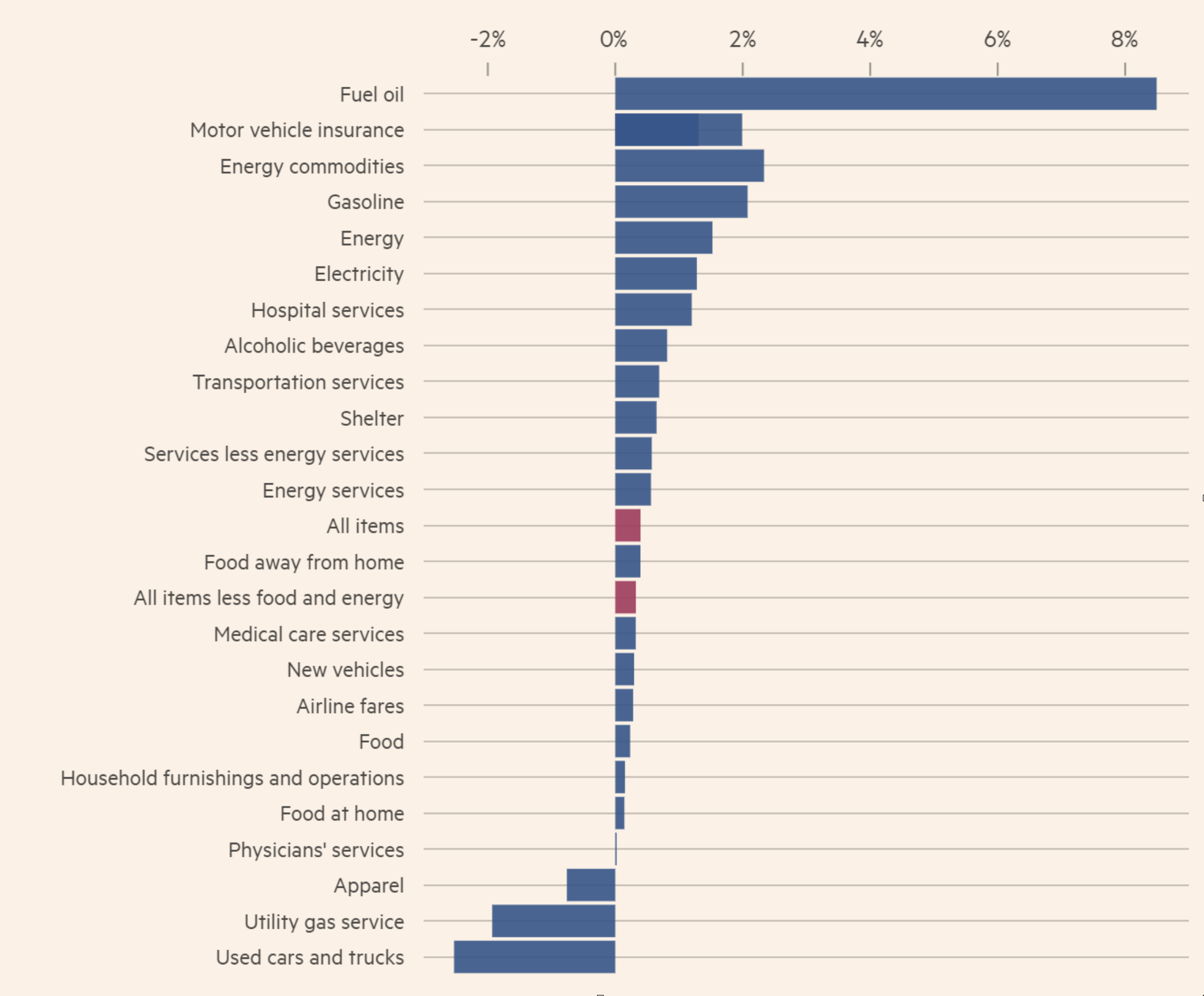

US inflation was higher than expected in September, fueling speculation that the Federal Reserve may raise interest rates once again. Following Russia’s invasion of Ukraine, global energy prices have skyrocketed, driving inflation globally with the US also being impacted as inflation rose to 9.1% in 2022. This led the Fed on an interest rate-hiking campaign which saw benchmark interest rates reach 5.5% in July- the highest since 2001. The hikes, along with decreasing global energy prices, saw US inflation decrease to a manageable 3% in June. Inflation has since floated around this figure until September, when the CPI rose to 3.7%, according to the Bureau of Labor Statistics. Some analysts now predict that the Fed may look to pre-empt any further rises in inflation with another interest rate hike.

Month-to-Month inflation for September -FT

The Argentinian Peso, one of the world’s worst-performing currencies in recent times, tumbled further against the dollar as voters and markets prepare themselves for the possible victory of radical rightwing libertarian, Javier Milei, who pledges to dollarise the economy. Since the war in Ukraine began, Argentina has been faced with its worst economic crisis in 2 decades with inflation recorded over 100% in 2022, and the development of a black-market currency. While the official exchange rate against the dollar has been fixed at 365, the black-market exchange rate has floated around 870. In an interview on October 11th, Milei, who is leading the polls for the presidential election next month, advised Argentinians against keeping their pesos in investment instruments denominated in pesos as he intends to dollarise the Argentinian economy. Consequently, the black-market exchange rate against the dollar increased by 7.4% to 945.

Eurozone

Rishi Sunak shocked the UK earlier this month as he announced serious slashes to the controversial High-Speed Rail 2 programme (HS2), a flagship project of the government’s ‘levelling up’ agenda. HS2 was announced in 2012 and was intended to transform Britain’s inadequate railway service by connecting the South to the North with state-of-the-art transport service between London, Birmingham, Manchester Leeds and other cities in the UK. The project has attracted much controversy due to the forced removal of residents and environmental concerns, but garnered support as it would significantly reduce travel times and improve national and inter regional transport. Costs, however, have drastically overran, leading Rishi Sunak to announce that the Birmingham to Manchester connection, amongst others, would be scrapped. HS2 will therefore run from London to Birmingham, leading some to deride the project as a mere ‘shuttle service’.

HS2 being scaled back significantly. FT.

Despite concerns over the country’s finances, Italian Prime Minister Giorgia Meloni plans to spend $24bn on tax cuts and public sector pay rises to boost the economy. Political turmoil and rising energy prices have left the Italian economy vulnerable and burdened with debt. Although generally enjoying a post-pandemic economic rebound, Italy’s economy shrank by 0.4% in Q2 2023 while its manufacturing sector contracted for a fifth consecutive month in August. Elsewhere, consumer prices have risen steeply, and Italy’s debt-to-GDP ratio sits at 145%. Accordingly, Meloni announced a €25bn package; €10bn of which will go to reducing mandatory social payments, €7bn of which will be spent on public sector salary increases, while €4.3bn will be spent on tax cuts for low and middle-income workers.

Asia

In what will come as a surprise to many, Afghanistan’s currency was the world’s best performing for the third quarter of the year. After removing and replacing the US-backed government in 2021, the new Taliban government suffered an economic collapse as sanctions were imposed by the US while foreign aid was withdrawn, leading GDP to contract by a fifth. The Taliban government have managed to stabilise the economy in recent months, imposing strict capital controls on the Afghani currency and ensuring the resumption of aid from international donors and the UN. The currency has subsequently rebounded and ranks as the word’s third best performing currency in 2023.

The Afghani has rebounded to pre-takeover levels. FT.

China’s president Xi Jinping praised his “deep friendship” with Vladimir Putin, as the two leaders met at the Belt and Road Iniative (BRI) forum, underscoring the close relationship between the two amid the war in Ukraine. Beijing and Moscow have drifted towards one another as tension with the US and its allies grows due to China’s growing economic and military influence and Russia’s invasion of Ukraine. Xi has taken an ambiguous stance towards Russia’s invasion of Ukraine, neither condemning nor supporting Putin. At this BRI summit, however, Xi affirmed the relationship, lauding the “historic(ally) high” levels of bilateral trade between the two, which reached $200bn this year. The news will come as a blow to the EU especially; an extremely important trading partner with China who are pushing for global condemnation of Russia’s military efforts.

A report released by the World Bank earlier this month provided a mixed forecast on the economic fortunes of Asian economies. The world bank raised its 2023 economic forecast for growth in south Asia, which includes India, Pakistan, Bangladesh and Sri Lanka, from 5.6 per cent to 5.8 per cent. Citing a young workforce and significant public investment as key reasons. On the other hand, the world bank downgraded economic forecasts for China and Southeast Asian economies such as Vietnam and Thailand due to US protectionism, rising debt levels which will reduce investment, and the latter two’s reliance on the Chinese economy, which the world bank expects to experience setbacks .

Africa

China’s CNGR Advanced Material, one of the world’s largest battery material producers, announced a $2bn investment in Morocco as Chinese companies look to divert investment away from Europe and the US due to geopolitical tensions. While China, the US and Europe remain important trading partners, the US’s fear that China’s economy is a challenge to its supremacy has seen political and economic tensions rise in recent years. The EU’s close relationship with the US has seen the bloc support Washington as Brussels gradually looks to reduce its reliance on China. In response, Beijing is also looking to increase its economic presence in different regions and has funnelled billions of dollars of investment towards Africa. Morocco appears to be the latest beneficiary of this policy as CNGR executive, Thorsten Lahrs, announced at the end of September that the Shenzhen-listed company would build a cathode materials plant in Morocco to supply the growing global demand for battery-making materials.

Angola is set to slow the removal of costly fuel subsidies in response to violent protests in June which caused the deaths of at least five people. Soaring energy and fuel prices following Russia’s invasion of Ukraine saw the Angolan government introduce significant fuel subsidies which amounted to $2.3bn in 2022. This represented more than 40% of what the government spent on social programmes and was deemed untenable by the Angolan government. In June, President Joao Lourenco cut subsidies which resulted in fuel prices doubling, leading to violent protests in Luanda, Benguela and Namibe. Lourenco responded by firing the economic coordination minister and it was announced earlier this month that the removal of the fuel subsidies would be slowed down.